Register Income Tax Malaysia

Provide copies of the following documents.

Register income tax malaysia. Register at the nearest irbm inland revenue board of malaysia lhdn lembaga hasil dalam negeri branch or register online at hasil gov my. 2 2 business registration certificate for malaysian citizen who carries on business. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing.

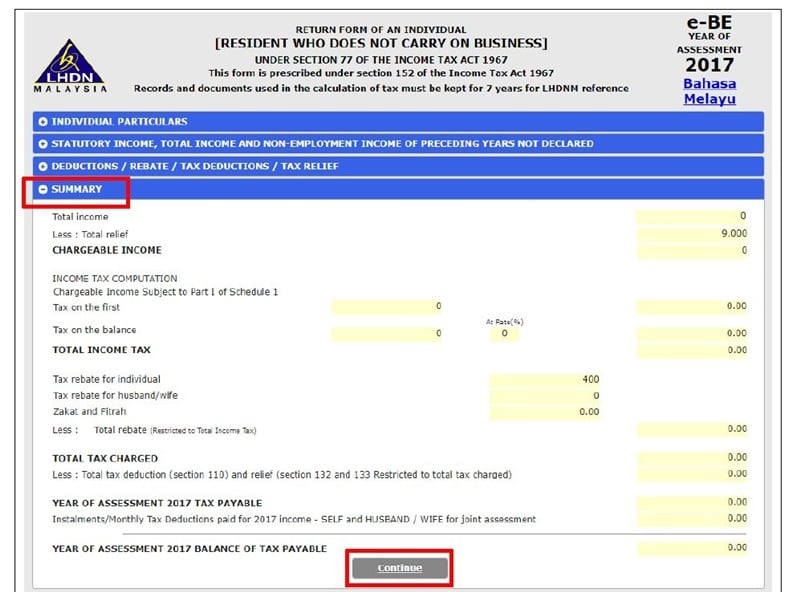

Before you can complete your income tax returm form itrf via ezhasil e filing the first step you have to take is to register at ezhasil e filing website. Residency for tax functions income tax malaysia. Please upload your application together with the following document.

This is the responsible agency operated by the ministry of finance malaysia. Visit the official inland revenue board of malaysia website. You can file your taxes on.

The income tax number is allocated by the inland revenue board of malaysia when you register for tax. Apply for pin number login for first time. Individual who has income which is liable to tax.

Who are required to register income tax file. Income tax malaysia the tax year runs in accordance with the calendar year starting on one january and ending on thirty one december. Individual who has business income.

Employee who is subject to monthly tax deduction mtd. A first timer s easy guide to filing taxes 2019. Supporting documents if you have business income.

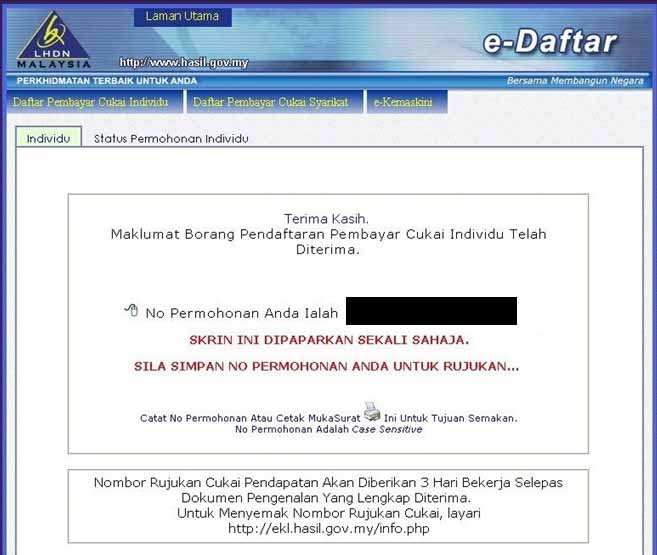

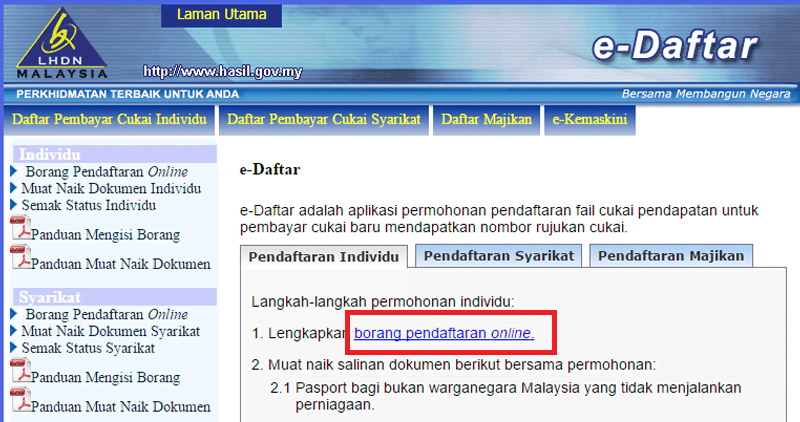

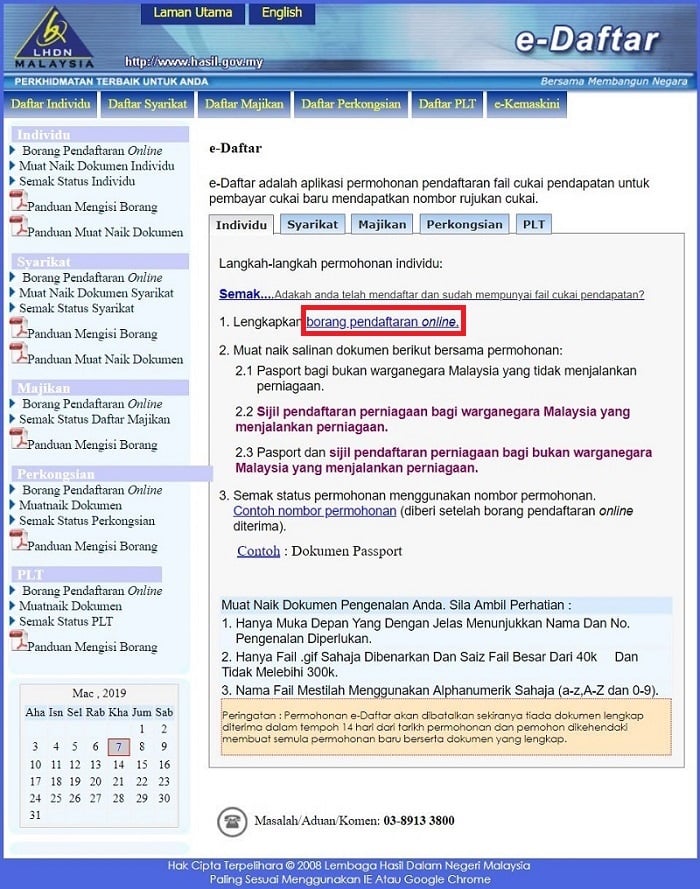

The process of registering is as follows. If you are newly taxable you must register an income tax reference number. An application via internet for the registration of income tax file for individuals companies employer partnership and limited liability partnership llp.

Registering for a malaysian tax number is not very complicated. Latest salary slip employed obtaining an income tax number if you do not hold but require an income tax number you should. Have you registered and have an income tax file.

150 tarikh kemaskini. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. If you do not have business income.

Register online through e daftar. Meanwhile for the b form resident individuals who carry on business the deadline is 15 july for e filing and 30 june for manual filing. If you already have a tax file registered from previous employment do submit your return form even if your annual or monthly income falls below the chargeable level rm34 000 after epf deduction.

You can do the registration either on line or at the nearest branch of the malaysian inland revenue board irbm lembaga hasil dalam negeri malaysia. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Please complete this online registration form.

However if you don t already have a tax file registered and your income is below the chargeable level you don t have to register a tax file.