Rpgt Exemption Malaysia 2019

There are some exemptions allowed for rpgt.

Rpgt exemption malaysia 2019. This too is effective 1 st january 2019. Malaysian citizens or permanent residents are allowed a once in a lifetime exemption on any chargeable gain from the disposal of a private residence. In the case of conditional contract such as paragraph 16 of schedule 2 of the rpgt act 1976 the rpgt exemption is given on gains from the disposal of properties transacted in the sixth year and beyond by malaysian citizens and permanent residents whereby the sale and purchase agreement has been signed before jan 1 2019.

According to the rpgt act certain tax exemptions apply to profits on selling property. How to calculate the year of your property disposal. Is malaysian entitled for rpgt exemption.

Yes for malaysian it is a once in a lifetime so you must not have applied before this or it could also mean for first time seller but only for residential property disposal. Exemption on gains from the disposal of one private residential property once in a lifetime to an individual please utilise this once in lifetime opportunity wisely. Read this for more info on rpgt in malaysia 2019.

Exemption of rpgt service tax from jan 1 2019 the government has agreed to exempt the real property gains tax rpgt to individual malaysian citizens who dispose of their properties at a consideration price of rm200 000 and below. Existing exemptions on rpgt include the disposal of a personal residence once in a lifetime disposal rm10 000 or 10 of chargeable gain transfer of ownership as a gift and allowable losses. Rpc is essentially a controlled company where its total tangible assets consists of 75 or more in real property and.

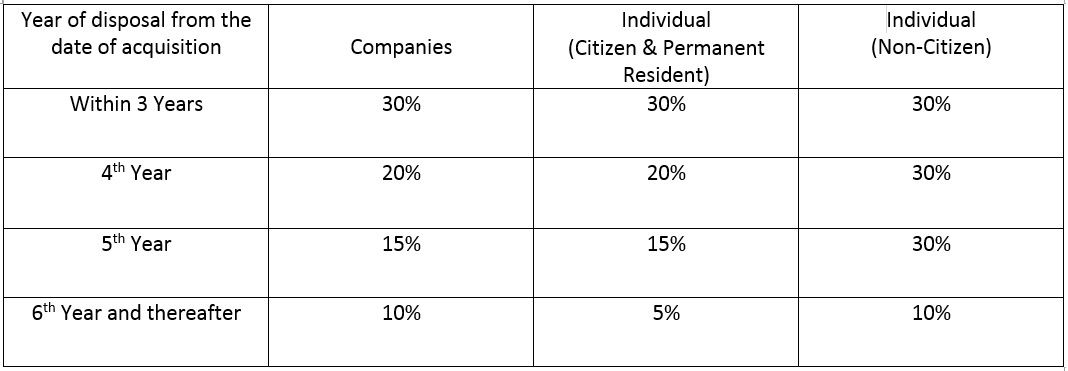

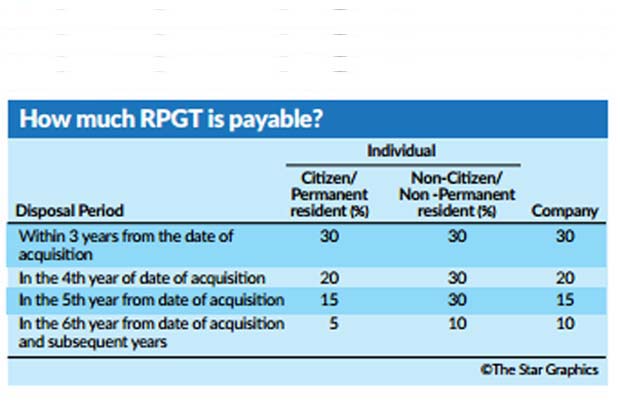

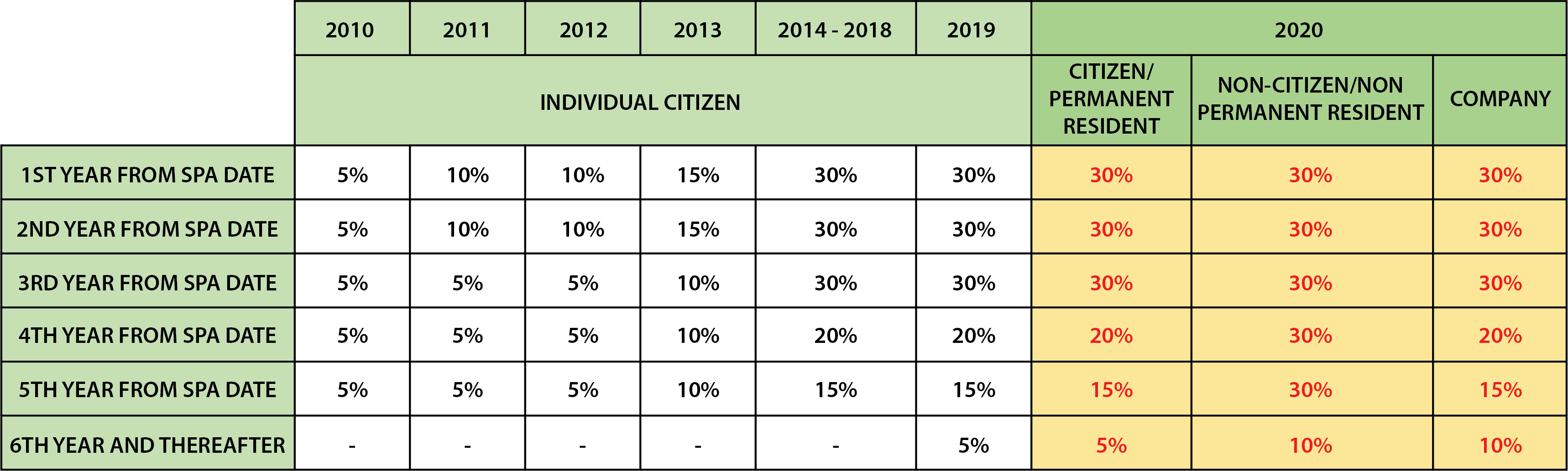

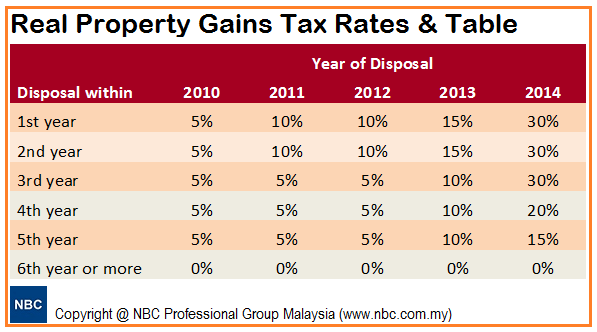

For individual seller if your sale purchase agreement is dated on 1st of jan 2016 and disposal new sale purchase agreement is dated on 31st march 2019. Real property is defined as any land situated in malaysia and any interest option or other right in or over such land. Every person whether or not resident is chargeable to rpgt on gains arising from disposal of real property including shares in a real property company rpc.

Your disposal year. By now most of us have a broad picture of belanjawan 2019 its highlights and perhaps have an opinion or two on who might be its victors and victims. If you owned the property for 12 years so you ll need to pay rpgt of 5.

The rpgt act defines a private residence as a building or part of a building owned by an individual or occupied as a place of residence. Among the exemptions are. In the case of conditional contract such as paragraph 16 of schedule 2 of the rpgt act 1976 the rpgt exemption is given on gains from the disposal of properties transacted in the sixth year and beyond by malaysian citizens and permanent residents whereby the sale and purchase agreement has been signed before jan 1 2019.

From it i have learnt the. In the case of conditional contract such as paragraph 16 of schedule 2 of the rpgt act 1976 the rpgt exemption is given on gains from the disposal of properties transacted in the sixth year and beyond by malaysian citizens and permanent residents whereby the sale and purchase agreement has been signed before jan 1 2019. 5 hike in real property gain tax rpgt in malaysia 2019.

Personally i am more interested in the property segment of the budget as i am a property investor myself.